Cost Management

Cost Management

Stop guessing at project margins and discovering budget overruns weeks after they've already happened.

Get real-time visibility into where every project stands financially. Catch budget issues when you can still fix them. Protect margins by knowing actual costs as they occur, not discovering overruns in hindsight.

The Problem: By the Time You Know You've Overspent, It's Too Late to Fix

You win a tender based on your construction estimate. Then costs start flowing: purchase orders get raised, variations get approved, invoices get paid. But nobody's tracking the cumulative impact in real-time against your original budget. Finance produces reports weeks or months later showing you've overspent on framing, earthworks, or materials—but by then, the work's done, the money's spent, and your margin is gone.

The fundamental issue is visibility lag. Your estimate exists in a spreadsheet. Your POs live in procurement. Your invoices process through accounts payable. Variations get approved by project managers. Nobody's connecting these in real-time to show: "You budgeted $50K for concrete, you've committed $48K via POs, you've been invoiced $45K, and you have $5K remaining—but there's one more pour to go that will cost $8K, so you're about to be $3K over budget."

Without this visibility, you can't make informed decisions about where to save costs, whether variations are eroding margin, or if the project is tracking profitably. You're flying blind until it's too late to course-correct.

The Solution: Live Cost Tracking From Tender Through Completion

Cost Management creates complete financial visibility by turning your construction estimate into a live budget that updates automatically as every procurement and payment happens.

Upload Construction Estimates Import your tender estimate into the system—all line items, quantities, rates, subtotals. This becomes your baseline budget: the cost structure you priced the project against. Every category tracked: earthworks, concrete, framing, electrical, plumbing, finishes—however granular your estimate was.

Dynamic Cost Breakdown Structure Every cost category shows complete financial picture:

Original Tender Budget: What you priced at tender

Variations: Approved changes adding or reducing scope

Live Budget: Current budget (tender + variations)

Cost Committed: Total POs raised against this category

Cost Incurred: Actual invoices paid (from AP)

Budget Remaining: Live budget minus cost incurred

See instantly: "Concrete was budgeted at $50K, variations added $5K, live budget is $55K, we've committed $52K via POs, paid $48K in invoices, have $7K remaining."

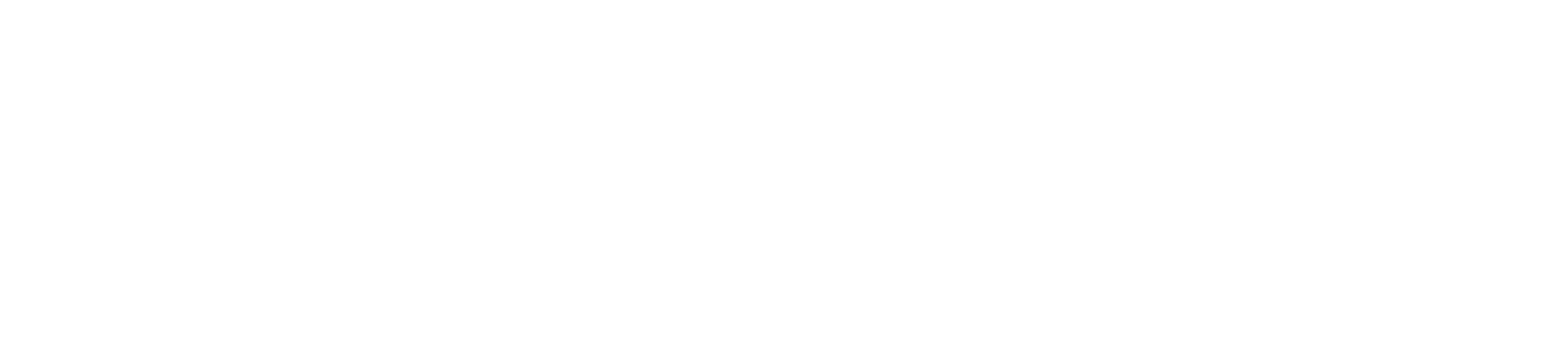

Automatic PO Tracking Against Budget Every purchase order created gets allocated to a cost category. When PO is raised for $10K of framing materials, that $10K shows as "committed" against framing budget immediately. You see budget commitment before the invoice arrives, giving advance warning of spend.

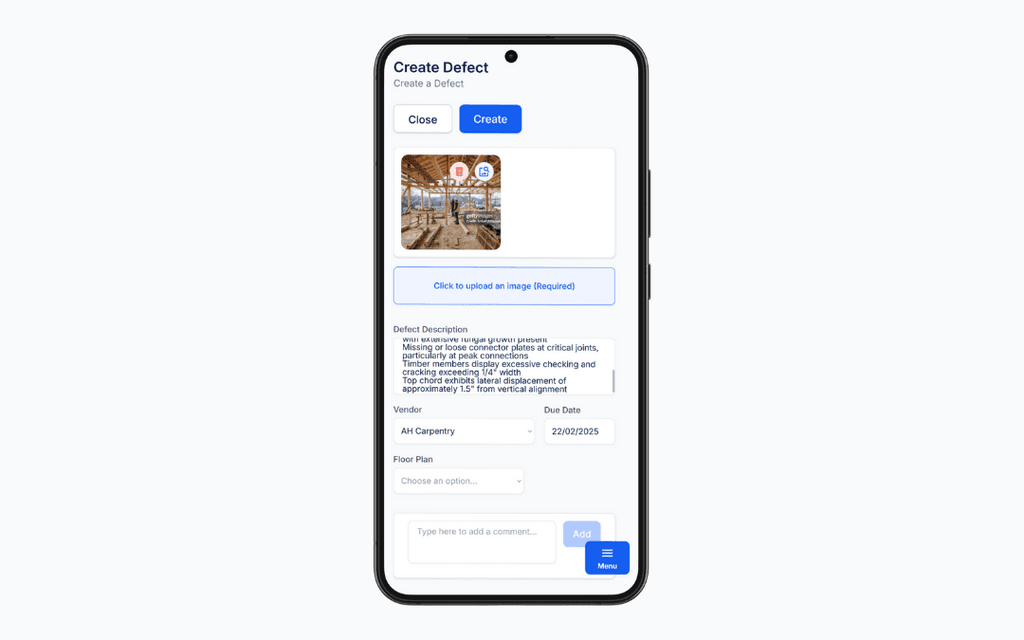

Invoice Allocation to Cost Categories Invoices reconcile against POs automatically, inheriting the cost category allocation. Invoice comes in for that framing PO? Cost incurred updates in real-time. No manual allocation. No waiting for finance to code expenses. Instant visibility into actual spend.

Variation Impact Visibility Client approves variation adding $15K? That flows through to live budget immediately, showing updated margin impact. Variations that erode contingency or reduce profit are visible as they're approved, not discovered later.

Contingency & Overhead Tracking Clearly see your contingency allocation and how much has been consumed. Track overhead costs separately from direct project costs. Know how much buffer remains before margin starts getting eaten.

Real-Time Margin Forecasting System calculates forecast margin based on: revenue (contract value + variations) minus costs incurred minus costs committed. See your projected profit now based on current commitments, not hoped-for profit based on tender pricing from months ago.

Multi-Project Financial Overview Managing multiple projects? See financial health across your entire portfolio: which projects are tracking to budget, which are overspending, where margin is eroding, where you're performing better than priced.

Cost Category Analysis Identify trends across projects: are you consistently over/under budget on specific trades? Is electrical always coming in under while concrete exceeds budget? Use actual data to improve future estimating.

Benefits & Outcomes

Catch Budget Overruns While You Can Still Fix Them See cost issues developing in real-time, not weeks later in finance reports. When framing commitments are tracking over budget but work isn't complete, you can value-engineer solutions, negotiate with suppliers, or prepare client variation requests—instead of discovering the overrun after money's already spent.

Know Your True Margin, Not Hoped-For Margin Forecast margin based on actual costs incurred plus committed POs shows realistic profit projection. No more pleasant surprises (rare) or nasty shocks (common) when final project costs are tallied. You know where you stand throughout the project.

Protect Contingency Intelligently See exactly how much contingency has been consumed and what remains. Make informed decisions about whether to absorb variations, pass them to clients, or find savings elsewhere. Contingency gets managed strategically, not depleted invisibly.

Better Variation Management When clients request changes, see immediate impact on margin. Decide whether to absorb, negotiate, or decline based on real financial position—not guesses about whether budget exists.

Improve Future Estimating Actual vs. budgeted data across projects improves future tender accuracy. Stop under-pricing concrete because you see you consistently exceed budget. Stop over-pricing finishes that always come in under. Historical data makes estimates more accurate.

Faster Month-End Close Finance doesn't spend days reconciling costs to projects—it's already done automatically as POs and invoices are processed. Month-end reports confirm what everyone already knows from real-time visibility.

Complete Cost Audit Trail Every budget line, every variation, every PO allocation, every invoice against category—automatically documented. Prove project costs when clients question variations or when stakeholders want financial transparency.

The Problem: By the Time You Know You've Overspent, It's Too Late to Fix

You win a tender based on your construction estimate. Then costs start flowing: purchase orders get raised, variations get approved, invoices get paid. But nobody's tracking the cumulative impact in real-time against your original budget. Finance produces reports weeks or months later showing you've overspent on framing, earthworks, or materials—but by then, the work's done, the money's spent, and your margin is gone.

The fundamental issue is visibility lag. Your estimate exists in a spreadsheet. Your POs live in procurement. Your invoices process through accounts payable. Variations get approved by project managers. Nobody's connecting these in real-time to show: "You budgeted $50K for concrete, you've committed $48K via POs, you've been invoiced $45K, and you have $5K remaining—but there's one more pour to go that will cost $8K, so you're about to be $3K over budget."

Without this visibility, you can't make informed decisions about where to save costs, whether variations are eroding margin, or if the project is tracking profitably. You're flying blind until it's too late to course-correct.

The Solution: Live Cost Tracking From Tender Through Completion

Cost Management creates complete financial visibility by turning your construction estimate into a live budget that updates automatically as every procurement and payment happens.

Upload Construction Estimates Import your tender estimate into the system—all line items, quantities, rates, subtotals. This becomes your baseline budget: the cost structure you priced the project against. Every category tracked: earthworks, concrete, framing, electrical, plumbing, finishes—however granular your estimate was.

Dynamic Cost Breakdown Structure Every cost category shows complete financial picture:

Original Tender Budget: What you priced at tender

Variations: Approved changes adding or reducing scope

Live Budget: Current budget (tender + variations)

Cost Committed: Total POs raised against this category

Cost Incurred: Actual invoices paid (from AP)

Budget Remaining: Live budget minus cost incurred

See instantly: "Concrete was budgeted at $50K, variations added $5K, live budget is $55K, we've committed $52K via POs, paid $48K in invoices, have $7K remaining."

Automatic PO Tracking Against Budget Every purchase order created gets allocated to a cost category. When PO is raised for $10K of framing materials, that $10K shows as "committed" against framing budget immediately. You see budget commitment before the invoice arrives, giving advance warning of spend.

Invoice Allocation to Cost Categories Invoices reconcile against POs automatically, inheriting the cost category allocation. Invoice comes in for that framing PO? Cost incurred updates in real-time. No manual allocation. No waiting for finance to code expenses. Instant visibility into actual spend.

Variation Impact Visibility Client approves variation adding $15K? That flows through to live budget immediately, showing updated margin impact. Variations that erode contingency or reduce profit are visible as they're approved, not discovered later.

Contingency & Overhead Tracking Clearly see your contingency allocation and how much has been consumed. Track overhead costs separately from direct project costs. Know how much buffer remains before margin starts getting eaten.

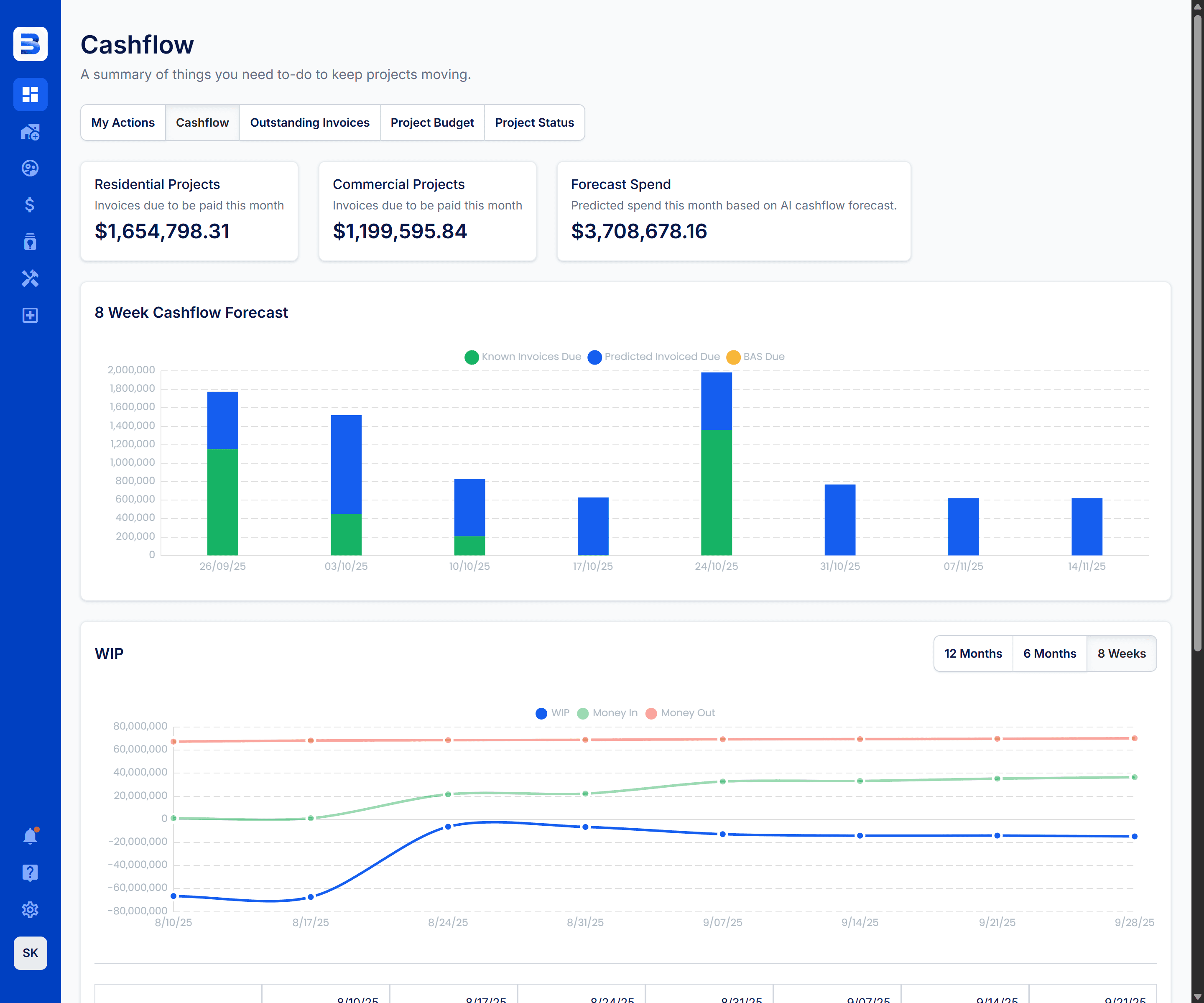

Real-Time Margin Forecasting System calculates forecast margin based on: revenue (contract value + variations) minus costs incurred minus costs committed. See your projected profit now based on current commitments, not hoped-for profit based on tender pricing from months ago.

Multi-Project Financial Overview Managing multiple projects? See financial health across your entire portfolio: which projects are tracking to budget, which are overspending, where margin is eroding, where you're performing better than priced.

Cost Category Analysis Identify trends across projects: are you consistently over/under budget on specific trades? Is electrical always coming in under while concrete exceeds budget? Use actual data to improve future estimating.

Benefits & Outcomes

Catch Budget Overruns While You Can Still Fix Them See cost issues developing in real-time, not weeks later in finance reports. When framing commitments are tracking over budget but work isn't complete, you can value-engineer solutions, negotiate with suppliers, or prepare client variation requests—instead of discovering the overrun after money's already spent.

Know Your True Margin, Not Hoped-For Margin Forecast margin based on actual costs incurred plus committed POs shows realistic profit projection. No more pleasant surprises (rare) or nasty shocks (common) when final project costs are tallied. You know where you stand throughout the project.

Protect Contingency Intelligently See exactly how much contingency has been consumed and what remains. Make informed decisions about whether to absorb variations, pass them to clients, or find savings elsewhere. Contingency gets managed strategically, not depleted invisibly.

Better Variation Management When clients request changes, see immediate impact on margin. Decide whether to absorb, negotiate, or decline based on real financial position—not guesses about whether budget exists.

Improve Future Estimating Actual vs. budgeted data across projects improves future tender accuracy. Stop under-pricing concrete because you see you consistently exceed budget. Stop over-pricing finishes that always come in under. Historical data makes estimates more accurate.

Faster Month-End Close Finance doesn't spend days reconciling costs to projects—it's already done automatically as POs and invoices are processed. Month-end reports confirm what everyone already knows from real-time visibility.

Complete Cost Audit Trail Every budget line, every variation, every PO allocation, every invoice against category—automatically documented. Prove project costs when clients question variations or when stakeholders want financial transparency.

The Problem: By the Time You Know You've Overspent, It's Too Late to Fix

You win a tender based on your construction estimate. Then costs start flowing: purchase orders get raised, variations get approved, invoices get paid. But nobody's tracking the cumulative impact in real-time against your original budget. Finance produces reports weeks or months later showing you've overspent on framing, earthworks, or materials—but by then, the work's done, the money's spent, and your margin is gone.

The fundamental issue is visibility lag. Your estimate exists in a spreadsheet. Your POs live in procurement. Your invoices process through accounts payable. Variations get approved by project managers. Nobody's connecting these in real-time to show: "You budgeted $50K for concrete, you've committed $48K via POs, you've been invoiced $45K, and you have $5K remaining—but there's one more pour to go that will cost $8K, so you're about to be $3K over budget."

Without this visibility, you can't make informed decisions about where to save costs, whether variations are eroding margin, or if the project is tracking profitably. You're flying blind until it's too late to course-correct.

The Solution: Live Cost Tracking From Tender Through Completion

Cost Management creates complete financial visibility by turning your construction estimate into a live budget that updates automatically as every procurement and payment happens.

Upload Construction Estimates Import your tender estimate into the system—all line items, quantities, rates, subtotals. This becomes your baseline budget: the cost structure you priced the project against. Every category tracked: earthworks, concrete, framing, electrical, plumbing, finishes—however granular your estimate was.

Dynamic Cost Breakdown Structure Every cost category shows complete financial picture:

Original Tender Budget: What you priced at tender

Variations: Approved changes adding or reducing scope

Live Budget: Current budget (tender + variations)

Cost Committed: Total POs raised against this category

Cost Incurred: Actual invoices paid (from AP)

Budget Remaining: Live budget minus cost incurred

See instantly: "Concrete was budgeted at $50K, variations added $5K, live budget is $55K, we've committed $52K via POs, paid $48K in invoices, have $7K remaining."

Automatic PO Tracking Against Budget Every purchase order created gets allocated to a cost category. When PO is raised for $10K of framing materials, that $10K shows as "committed" against framing budget immediately. You see budget commitment before the invoice arrives, giving advance warning of spend.

Invoice Allocation to Cost Categories Invoices reconcile against POs automatically, inheriting the cost category allocation. Invoice comes in for that framing PO? Cost incurred updates in real-time. No manual allocation. No waiting for finance to code expenses. Instant visibility into actual spend.

Variation Impact Visibility Client approves variation adding $15K? That flows through to live budget immediately, showing updated margin impact. Variations that erode contingency or reduce profit are visible as they're approved, not discovered later.

Contingency & Overhead Tracking Clearly see your contingency allocation and how much has been consumed. Track overhead costs separately from direct project costs. Know how much buffer remains before margin starts getting eaten.

Real-Time Margin Forecasting System calculates forecast margin based on: revenue (contract value + variations) minus costs incurred minus costs committed. See your projected profit now based on current commitments, not hoped-for profit based on tender pricing from months ago.

Multi-Project Financial Overview Managing multiple projects? See financial health across your entire portfolio: which projects are tracking to budget, which are overspending, where margin is eroding, where you're performing better than priced.

Cost Category Analysis Identify trends across projects: are you consistently over/under budget on specific trades? Is electrical always coming in under while concrete exceeds budget? Use actual data to improve future estimating.

Benefits & Outcomes

Catch Budget Overruns While You Can Still Fix Them See cost issues developing in real-time, not weeks later in finance reports. When framing commitments are tracking over budget but work isn't complete, you can value-engineer solutions, negotiate with suppliers, or prepare client variation requests—instead of discovering the overrun after money's already spent.

Know Your True Margin, Not Hoped-For Margin Forecast margin based on actual costs incurred plus committed POs shows realistic profit projection. No more pleasant surprises (rare) or nasty shocks (common) when final project costs are tallied. You know where you stand throughout the project.

Protect Contingency Intelligently See exactly how much contingency has been consumed and what remains. Make informed decisions about whether to absorb variations, pass them to clients, or find savings elsewhere. Contingency gets managed strategically, not depleted invisibly.

Better Variation Management When clients request changes, see immediate impact on margin. Decide whether to absorb, negotiate, or decline based on real financial position—not guesses about whether budget exists.

Improve Future Estimating Actual vs. budgeted data across projects improves future tender accuracy. Stop under-pricing concrete because you see you consistently exceed budget. Stop over-pricing finishes that always come in under. Historical data makes estimates more accurate.

Faster Month-End Close Finance doesn't spend days reconciling costs to projects—it's already done automatically as POs and invoices are processed. Month-end reports confirm what everyone already knows from real-time visibility.

Complete Cost Audit Trail Every budget line, every variation, every PO allocation, every invoice against category—automatically documented. Prove project costs when clients question variations or when stakeholders want financial transparency.

Frequenly asked questions

Frequenly asked questions

Frequenly asked questions

How detailed does our construction estimate need to be?

As detailed as you want cost tracking. Some builders track at high level (sitework, structure, finishes), others track every trade separately. System adapts to your estimate structure—more detail gives better visibility but requires more granular PO allocation.

What if we raise POs that don't perfectly match estimate categories?

You allocate POs to the closest relevant category or split across multiple categories if needed. The goal is tracking spend against budget—doesn't need to be perfectly aligned to tender line items as long as you're capturing costs.

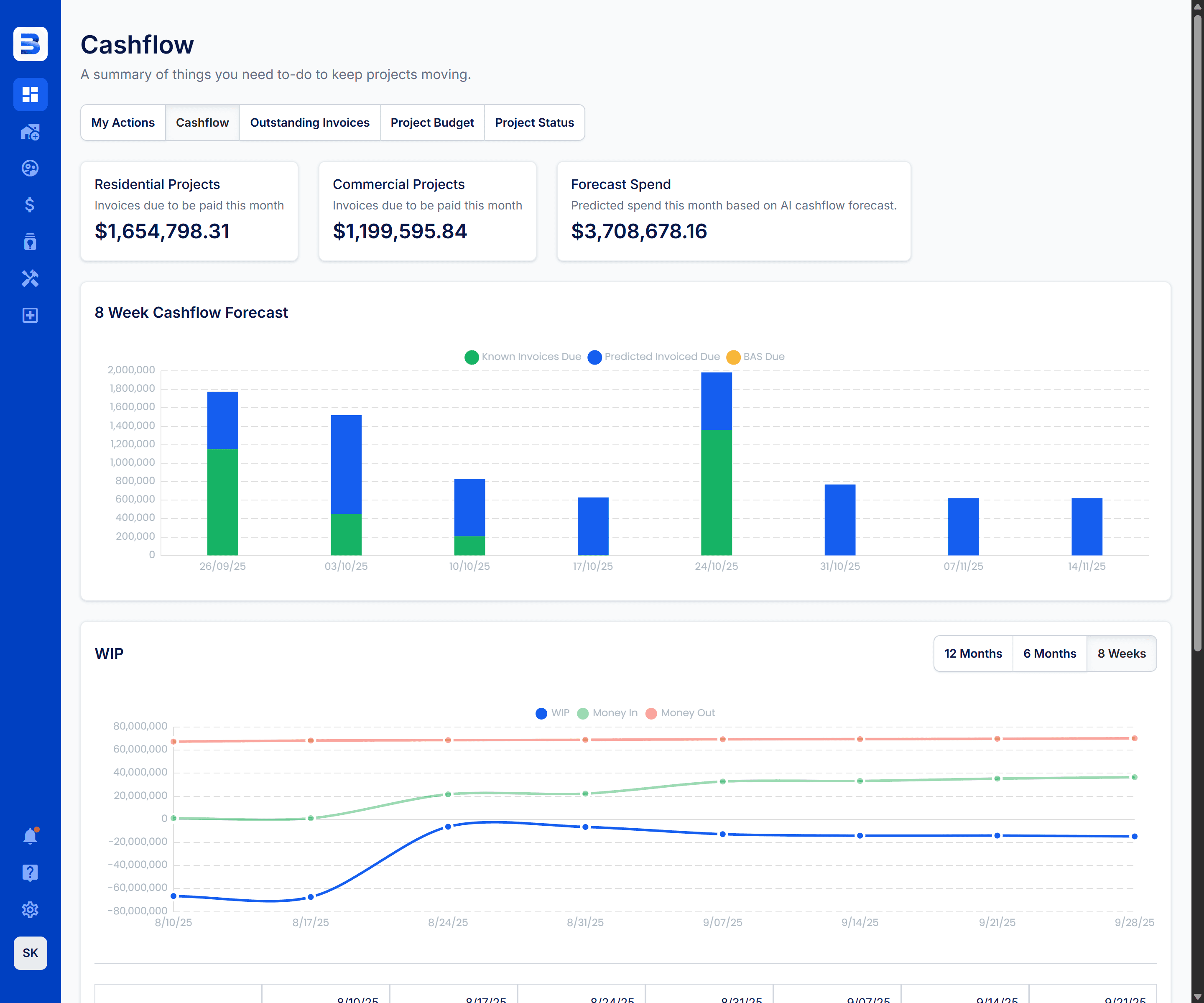

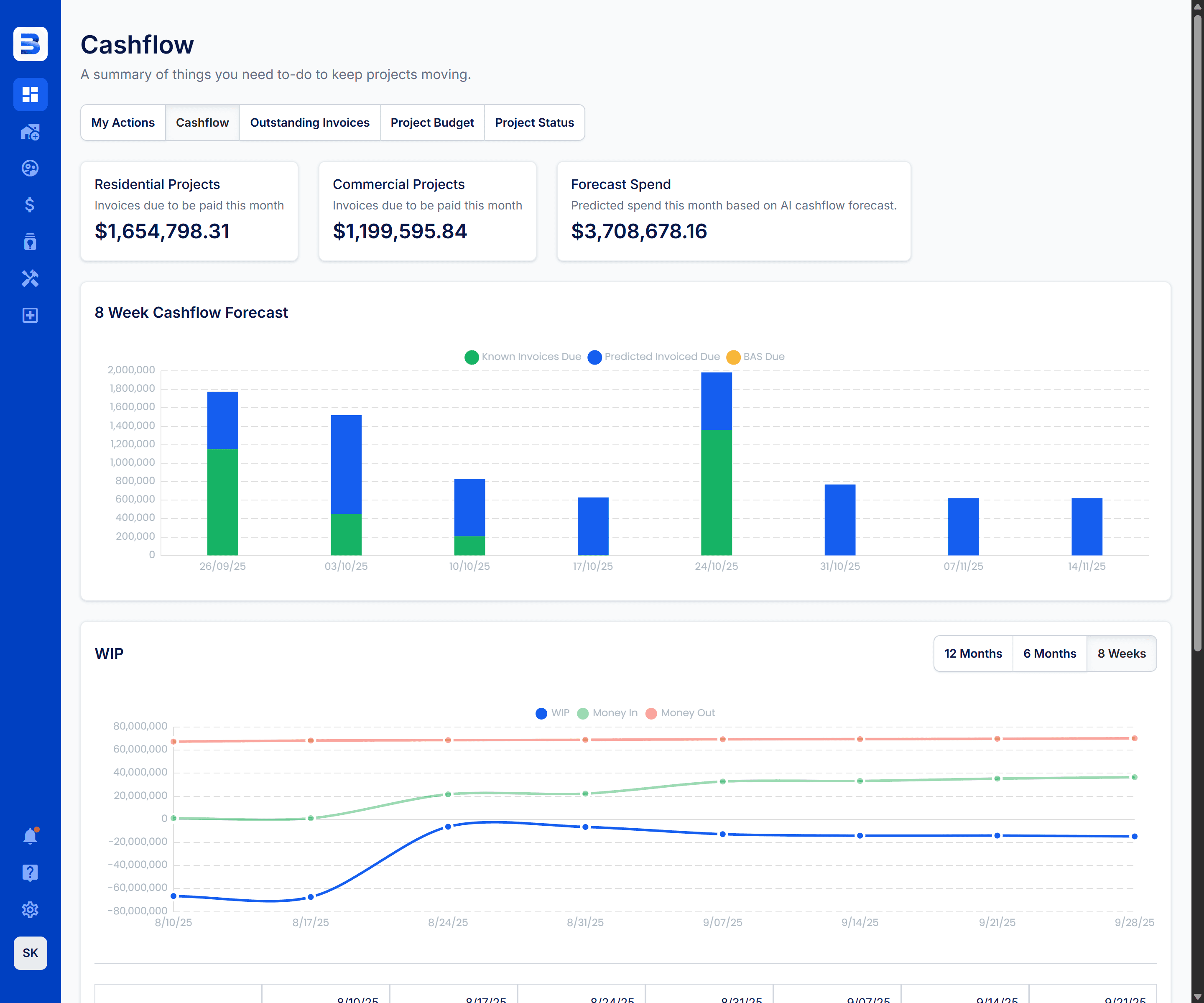

Can we see cash flow—when money is actually going out?

Yes—cost incurred (invoices paid) shows actual cash outflow, while cost committed (POs raised) shows future cash requirements. Helps forecast cash flow needs before bills are due.

What happens if we forgot to raise a PO and an invoice arrives?

Invoice can still be allocated to the appropriate cost category even without a PO. It shows directly as cost incurred. You lose the "committed" advance warning but still track actual spend against budget.

Can we compare actual costs against industry benchmarks?

System tracks your actual costs per square meter, per lot, or per project. Over time you build your own benchmarks showing typical costs for similar projects—more relevant than generic industry data because it reflects your specific standards and markets.

How does this help with client variations?

When client requests a change, you can instantly see: current margin position, contingency remaining, budget available. Make informed decisions about pricing variations based on real project financials, not guesses.

How detailed does our construction estimate need to be?

As detailed as you want cost tracking. Some builders track at high level (sitework, structure, finishes), others track every trade separately. System adapts to your estimate structure—more detail gives better visibility but requires more granular PO allocation.

What if we raise POs that don't perfectly match estimate categories?

You allocate POs to the closest relevant category or split across multiple categories if needed. The goal is tracking spend against budget—doesn't need to be perfectly aligned to tender line items as long as you're capturing costs.

Can we see cash flow—when money is actually going out?

Yes—cost incurred (invoices paid) shows actual cash outflow, while cost committed (POs raised) shows future cash requirements. Helps forecast cash flow needs before bills are due.

What happens if we forgot to raise a PO and an invoice arrives?

Invoice can still be allocated to the appropriate cost category even without a PO. It shows directly as cost incurred. You lose the "committed" advance warning but still track actual spend against budget.

Can we compare actual costs against industry benchmarks?

System tracks your actual costs per square meter, per lot, or per project. Over time you build your own benchmarks showing typical costs for similar projects—more relevant than generic industry data because it reflects your specific standards and markets.

How does this help with client variations?

When client requests a change, you can instantly see: current margin position, contingency remaining, budget available. Make informed decisions about pricing variations based on real project financials, not guesses.

How detailed does our construction estimate need to be?

As detailed as you want cost tracking. Some builders track at high level (sitework, structure, finishes), others track every trade separately. System adapts to your estimate structure—more detail gives better visibility but requires more granular PO allocation.

What if we raise POs that don't perfectly match estimate categories?

You allocate POs to the closest relevant category or split across multiple categories if needed. The goal is tracking spend against budget—doesn't need to be perfectly aligned to tender line items as long as you're capturing costs.

Can we see cash flow—when money is actually going out?

Yes—cost incurred (invoices paid) shows actual cash outflow, while cost committed (POs raised) shows future cash requirements. Helps forecast cash flow needs before bills are due.

What happens if we forgot to raise a PO and an invoice arrives?

Invoice can still be allocated to the appropriate cost category even without a PO. It shows directly as cost incurred. You lose the "committed" advance warning but still track actual spend against budget.

Can we compare actual costs against industry benchmarks?

System tracks your actual costs per square meter, per lot, or per project. Over time you build your own benchmarks showing typical costs for similar projects—more relevant than generic industry data because it reflects your specific standards and markets.

How does this help with client variations?

When client requests a change, you can instantly see: current margin position, contingency remaining, budget available. Make informed decisions about pricing variations based on real project financials, not guesses.

The difference between profitable projects and margin erosion is knowing your costs as they happen—not discovering overruns in hindsight when it's too late to fix them. Every day you operate without real-time cost visibility is another day budget issues compound before you notice.

Cost Management gives you what you need: live budget tracking, automatic PO and invoice allocation, real-time margin forecasting. You see problems while there's still time to course-correct, protect contingency strategically, and deliver projects at the margins you priced—not the margins that evaporated without you noticing.

The difference between profitable projects and margin erosion is knowing your costs as they happen—not discovering overruns in hindsight when it's too late to fix them. Every day you operate without real-time cost visibility is another day budget issues compound before you notice.

Cost Management gives you what you need: live budget tracking, automatic PO and invoice allocation, real-time margin forecasting. You see problems while there's still time to course-correct, protect contingency strategically, and deliver projects at the margins you priced—not the margins that evaporated without you noticing.

The difference between profitable projects and margin erosion is knowing your costs as they happen—not discovering overruns in hindsight when it's too late to fix them. Every day you operate without real-time cost visibility is another day budget issues compound before you notice.

Cost Management gives you what you need: live budget tracking, automatic PO and invoice allocation, real-time margin forecasting. You see problems while there's still time to course-correct, protect contingency strategically, and deliver projects at the margins you priced—not the margins that evaporated without you noticing.

Other Services

Other Services

Other Services

Sometimes the hardest part is reaching out — but once you do, we’ll make the rest easy.

Sometimes the hardest part is reaching out — but once you do, we’ll make the rest easy.

Sometimes the hardest part is reaching out — but once you do, we’ll make the rest easy.